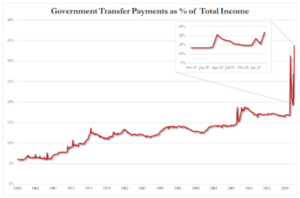

This week I came across a statistic that shocked me. It turns out that 34% of all US income currently comes from the government. Here’s a chart from an article on ZeroHedge showing the rise of government “transfer payments” to citizens.

I just can’t believe that more than a third of the entire nation’s income is currently dependent on the federal government. That number includes stimulus checks, unemployment benefits, welfare, social security, etc.

Many people think that once the COVID-19 crisis is over, things will return to normal. But I don’t think so. Back in the 1960s, only around 7% of all income came from the government. That figure had grown to around 17% before this most recent crisis began. The pandemic merely accelerated a trend that was already in place.

Once a government benefit is in place, it’s very difficult to cancel it. We seem destined to enact “universal basic income,” where everyone gets a monthly stipend.

Workers Not Rejoining The Workforce

One of the most troubling aspects of all of this is the unintended consequences. When you give people just enough money to get by, there’s the risk that some of them will lose their motivation to work. What’s the point in working when you can collect almost the same paycheck by not working?

Now that the crisis is winding down and many are vaccinated, companies are having trouble hiring. Bloomberg just ran a feature article about this “Job Paradox.” Here’s an excerpt talking about how some economists view the situation.

“…the labor force participation rate remains well below pre-pandemic levels…

And anyone who previously made less than $32,000 per year is better off financially in the near term receiving unemployment benefits, according to economists at Bank of America.“

Other reasons for people not returning to work include looking for jobs with benefits and jobs with a guaranteed number of minimum hours. Needless to say, I am extremely sympathetic to all the people put out of work by COVID-19. It’s an awful thing, and we do need to support these people until they can return to work. I am, however, also concerned about the direction we’re headed with all of this.

We’re going to have to print money to pay for all these programs — and that doesn’t happen without consequences. I think we’re likely to see stagflation (slow growth and high inflation) that could last a while.

I don’t really see any way to avoid what’s coming. More spending, more debt, more inflation. This, in short, is why investors need hedges.