Note: The COVID-19 pandemic has impacted everything from education to events to healthcare. So it makes sense that it’s impacted the investment landscape too. But while traditional venture capital firms have had to change some of their methods, investing online is nothing new for crowdfunders. So did 2020 dampen investor appetites?

Our friends at KingsCrowd explore that question in today’s Chart of the Week. Using a combination of KingsCrowd data and outside sources, they compare how investments in early stage companies in the online private markets compare to traditional venture capital in 2020. You can read the full article on the KingsCrowd website here.

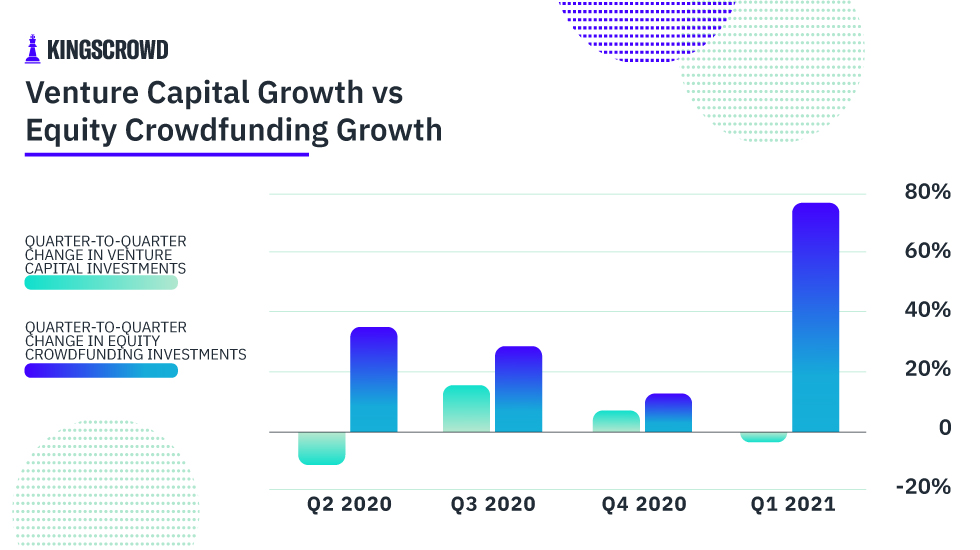

The COVID-19 pandemic has had a distinct impact on investing. Many people began participating more in the stock market, but the private markets were also affected. Venture capitalists (VCs) had to change how they vetted potential investments as they were unable to meet face-to-face with founders for much of the year. The online private markets also saw a major increase in activity, both in the number of companies raising funds and the number of investors participating in rounds. So how did investments in early stage companies in the online private markets compare to traditional VC in 2020? That’s the question this Chart of the Week intends to answer.

We used a Crunchbase article to get the funding data for seed and angel investments (what we’d define as “early”) from VC. For the online private markets, we used our own data. Additionally, we’re comparing the same time frame outlined in the Crunchbase article — 2020 funding data up to the first quarter of 2021. Lastly, we decided to track the quarter-to-quarter change for both VC and equity crowdfunding. This comparison allows us to focus on the growth (or lack thereof) in each market, which is a better indicator of activity and potential than simply comparing the size of investments.