Note from Early Investing Senior Editor Allison Brickell: It takes a lot of work for a startup founder to secure funding. As our own Vin Narayanan wrote back in 2019, “Raising money is hard. It’s a grind. No matter how tired or frustrated you are, you always have to be ‘on.’”

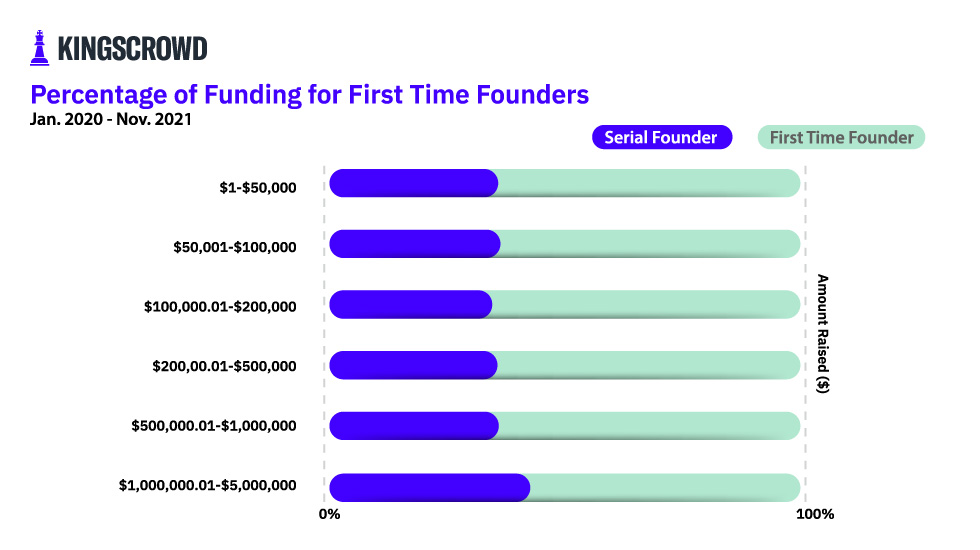

Founders that have started multiple companies – serial entrepreneurs – can sometimes use their experience to their advantage when raising money. In the venture capital world, serial founders generally secure more money than first-time founders. They’re seen as more knowledgeable and capable than founders that are just getting started. But as our friends at KingsCrowd have discovered, online startup investing has challenged that paradigm. In this recent Chart of the Week, they explore how crowdfunding seems to have leveled the playing field.

Serial entrepreneurship – where individuals found multiple companies – has long been viewed as an indicator of success. Although some venture capitalists (VCs) prefer to invest in entrepreneurs who are first founders, there is a lot of evidence and research suggesting that serial entrepreneurs raise more capital from VCs at large. But online startup investing has challenged the traditional VC model. With founders now able to reach a much wider audience of investors, has crowdfunding changed the likelihood of success for first-time founders?

In this Chart of the Week, we consider whether serial founders have an advantage in raising capital via equity crowdfunding. We examined all Regulation Crowdfunding (Reg CF) raises from January 2021 through November 2021 and compared the amount of capital raised by serial founders vs first-time founders. Across more than 580 raises, 63.5% of founders had no prior experience with starting a company. Just under 215 founders were serial entrepreneurs – 36.5% in total.