Earlier this week, I visited my old stomping grounds in Washington, D.C. to cover a pair of Congressional hearings about cryptocurrencies.

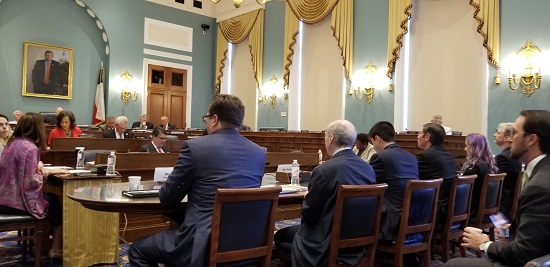

If you’ve never been to a Congressional hearing, you should try to attend one. They’re actually open to the public. And there’s no need to sign up or get tickets. But show up early! Seating is extremely limited. At the House Committee on Agriculture, there’s room for about 25 spectators – not including a press table that seats about six reporters (that’s where I was). At the House Financial Services Committee, there’s room for about a dozen spectators. The remaining dozen chairs are reserved for Congressional staff and reporters.

I’ve covered my share of House and Senate hearings – and it never gets old. The rooms that hold these meetings are impressive, awe-inspiring and intimidating. And that’s by design.

The witnesses testifying before Congress are typically the smartest, most accomplished professionals in their field. Members of Congress are not usually described that way.

That’s why the legislators sit on raised platforms and desks while the witnesses testifying before them sit at the bottom of the room, staring up at the bright lights and people in power. It’s a power play – a not-so-subtle reminder that it doesn’t matter how rich or accomplished you are. In that moment, you are answering to Congress.

If you think that such an obvious and dramatic power play wouldn’t rattle truly accomplished people, think again. As I talked to the crypto experts who testified on Wednesday, their reactions ranged from “that was terrifying” to “well, that could have gone worse.”

So how did the “crypto double-header” go on Wednesday? Actually, way better than expected.

For the first time, there seems to be an emerging consensus from the crypto industry about how cryptocurrencies should be regulated. Even better, the suggested framework was either tacitly accepted or (at worst) unchallenged by the politicians in attendance.

In oral and written testimony to the Agriculture Committee, Perkins Coie Managing Partner Lowell Ness outlined a two-phase approach to regulating cryptocurrencies (emphasis mine):

- Pre-Functionality – Until the token achieves full functionality, offers and sales of tokens would generally constitute investment contract type securities under Howey, unless a reasonable purchaser is purchasing with consumptive intent. In this case, the token should generally be treated as a security unless use of the token (as opposed to resale) is reasonably certain.

- Full Functionality – Once the token achieves full functionality, offers and sales of tokens would generally not constitute investment contracts under Howey. Software networks, however, generally require ongoing updates and upgrades, so it may be appropriate to create limited but ongoing investor protections.

This regulatory approach to cryptocurrencies is both innovative and remarkably practical. It allows for cryptocurrencies to be defined as securities (and regulated by the SEC) when they’re being created and developed. Once the development phase is over, so is the “third party” work that adds value to the coin (that’s the Howey test at play). At that point, the cryptocurrency becomes a commodity and can be traded without SEC oversight.

This new “hybrid” asset class formalizes a conclusion the SEC has already reached about ethereum. Here’s what the SEC’s corporate finance division director, William Hinman, said about ethereum in a speech in San Francisco (emphasis mine):

And putting aside the fundraising that accompanied the creation of ether, based on my understanding of the present state of ether, the ethereum network and its decentralized structure, current offers and sales of ether are not securities transactions. And, as with bitcoin, applying the disclosure regime of the federal securities laws to current transactions in ether would seem to add little value.

Reading between the lines, the SEC’s view of ethereum matches up pretty nicely with the proposed regulatory scheme. In the minds of the regulatory agency, when ethereum was in its development phase, its initial coin offering (ICO) constituted a sale of securities. The coins were an investment that investors hoped would rise in value based on the work/efforts of a third party. But once ethereum launched, its decentralized nature and usage made it a commodity.

If this seems like pretty technical stuff, well, it is. But it’s also critically important. The marketplace needs clarity and certainty in order to mature. It also needs a light regulatory touch. Anything less than that will stifle growth. And this path potentially walks that tightrope.

In many ways, Wednesday’s hearings mark a sea change in the government’s approach to cryptocurrencies. It was a significant effort to create a positive, constructive framework for cryptocurrencies.

At previous crypto hearings, much of the discussion (by politicians) centered on people using bitcoin for nefarious purposes like money laundering, dodging U.S. sanctions, smuggling drugs and whatever other shady activities people could think of.

And there was still some of that on Wednesday. Over at the House Financial Services Monetary Policy and Trade subcommittee hearing, Rep. Brad Sherman (D-Calif.) said:

There is nothing that can be done with cryptocurrency that cannot be done with sovereign currency that is meritorious and helpful to society. The role of the U.S. dollar in the international financial system is a critical component of U.S. power. It brought Iran to the negotiating table… We should prohibit U.S. persons from buying or mining cryptocurrencies… As a medium of exchange, cryptocurrency accomplishes nothing, except facilitating narcotics trafficking, terrorism and tax evasion.

Sherman wasn’t the only member of Congress who shared that sentiment. Fortunately, it’s both laughable and provably false. As Andreessen Horowitz Managing Partner Scott Kupor noted in the Agriculture Committee hearing, the digital trail created by bitcoin allows law enforcement officials to track down criminals – including Russian hackers.

Sherman (and others like him) is now the outlier in Congress. Even his fellow subcommittee members looked like they were just humoring him because he put on a good a show. Far more prevalent was the approach of Agricultural Committee Chairman Mike Conaway (R-Texas):

For the first time, we have a tool that enables individuals to reliably exchange value in the digital realm, without an intermediary. We can have assets that exist – and can be created, exchanged and consumed – in digital form. The promise of being able to secure property rights in a digital space may fundamentally change how people interact with one another. This technology holds the potential to bring enormous benefits to each of us, if we are willing to give it the space to grow. Providing a strong, clear legal and regulatory framework for digital assets is essential.

We’ve moved from the “bitcoin is bad” era to the bitcoin acceptance era. That’s a huge step forward. Let’s celebrate that before we think about the next step – getting Congress to pass crypto-friendly legislation.