If I asked you what the best thing about bitcoin is, I’m pretty sure most of you would answer, “Its upside.”

It makes perfect sense. But not everybody would agree with you.

Bitcoin has another, more hidden gift. It hasn’t been explored or discussed much. And it’s just as extraordinary (if not more) than bitcoin’s upside.

Savvy investors know what’s going on… but in a vague way.

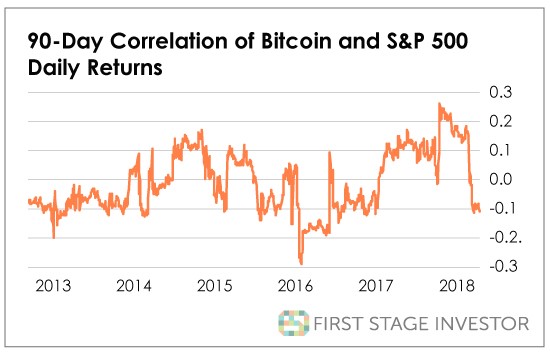

It’s about time somebody shed more light on this extremely important issue. Here’s a chart that gets the ball rolling…

This chart is about correlation… how much (or how little) bitcoin reacts to the S&P’s movements – both up and down.

How Correlation Works

If bitcoin mostly tags along with the S&P, rising and falling with the stock index, it’s “highly correlated.” Highly correlated assets are those with a correlation score between 70% [correlated] and 100% [correlated]. Strong correlations begin at 50%.

That’s one scenario. Another is bitcoin follows the S&P up but rarely down. In that case, it would earn something near a 50% correlation. You apply the same calculation if bitcoin follows the S&P down but seldom up.

OK, hope you’re still with me! I’ve just explained positive correlation. Are you ready to be introduced to negative (or inverse) correlation?

It’s when bitcoin does the opposite of the S&P. The S&P goes up, bitcoin reliably goes down. The S&P goes down, bitcoin goes up. If it happens more often than not, then the negative correlation will be 50% or more.

Since this is negative correlation we’re talking about, it’s expressed as a negative number of -50% or more. The stronger the negative correlation, the bigger the negative number (a -90%, for example, means the correlated assets are moving almost in unison in opposite directions).

Many assets are highly correlated. Some examples of positive correlation are S&P stocks to Nasdaq stocks… forestry products to real estate prices… domestic stocks to international stocks (which wasn’t the case 10 years ago).

Examples of high negative correlation are harder to find, but here are a few: dollar to gold… big oil companies (like Exxon) to airline companies… and bonds to money. (Think of interest rates as the price of money. As interest rates rise, the price of bonds fall.)

So, now that you understand the basics of correlation, you’ll appreciate what I’m about to tell you…

Assets have become remarkably correlated, especially following the financial crisis of 2008.

The positive correlation to stocks of everything but U.S. Treasurys increased sharply in 2008-2009, according to Fidelity. And now?

Treasurys have also become positively correlated, when they once were negatively correlated.

And non-correlated assets?

Well, they’ve become a rarity. And that’s not a good thing.

It has made a diversified portfolio – where the losses of some assets are cushioned by the gains of other assets – very hard to construct.

And very expensive.

Investors must pay big bucks to participate in hedge funds and private equity, which are considered non-correlated investments.

Bitcoin to the Rescue

Now, with bitcoin, that’s no longer the case.

Remember, strong correlation is anything 50% or higher. Bitcoin’s correlation to U.S. stocks hovers just above 30% at its highest. Negative correlation doesn’t even reach -20%.

Correlation is negligible in both directions.

And anybody can buy bitcoin. You don’t have to be wealthy. You don’t have to write a $250,000 check to a hedge fund.

That makes bitcoin a highly attractive asset class – one of the few that facilitates diversification.

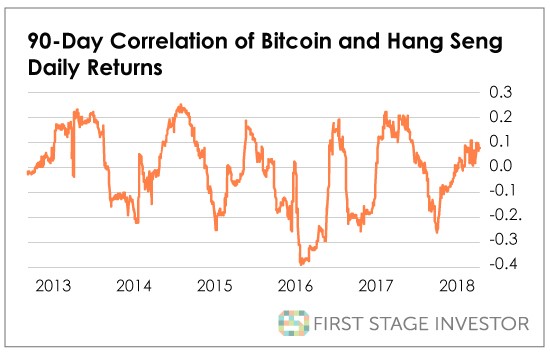

It’s even more attractive when you consider this chart…

The Hang Seng is the index used to measure movement in Hong Kong’s stock exchange. Bitcoin shows little correlation to Chinese stocks. The positive correlation peaks at just over 20%, and negative correlation almost reaches -40% at one point. I also ran similar charts comparing bitcoin with the stock markets of England, Japan, India and Germany.

They all showed the same or even lower correlation than the Hang Seng chart.

The data generated by the First Stage Investor team shows bitcoin to be a truly non-correlated asset to many stocks all over the world. What makes this such a big deal is that you don’t have to be wealthy to own bitcoin.

But here’s the thing (and it’s pretty ironic)…

Wealthy investors may be big players in institutional funds…

BUT THESE FUNDS DO NOT BUY BITCOIN… at least not yet.

Many of the issues preventing them from buying bitcoin will be going away soon, including regulatory clarity, custodial security and insurance coverage.

It’s just a matter of time before these institutional players become big buyers of bitcoin and other cryptocurrencies that offer the twin benefits of upside and non-correlation.

And that time is coming soon.

If I were you, I’d hop aboard the crypto train sooner as opposed to later. After all, YOU don’t have to wait.

Good investing,

Andy Gordon

Co-Founder, First Stage Investor